takeaway

Yantian Port has resumed normal operations, with delays continuing due to a large backlog of cargo. The market is grappling with backlogs, ship delays, jumps and a shortage of shipping space. As demand soars, market participants are making long-term preparations to ease the current congestion, and every container ship that can sail is now in demand. The need for capacity to cope with the huge volume of goods moving around the world means that almost all available container ships are in service.

A raft of new ship orders last week, including Seaspan, HMM and Wan Hai, all increased their shipbuilding orders because of capacity shortages. None of this, however, will do much to address the looming crisis in the container transport supply chain. Congestion at ports and inland areas is leading to a shortage of available equipment that continues to affect the development of the beleaguered container supply chain.

S? Speaking at the International Ports and Ports Association Congress, Ren Toft called for greater cooperation between ports and carriers to tackle the problem. But he warned that more investment was also needed and called for a "long-term strategic view" on infrastructure investment.

Following congestion in Los Angeles and Long Beach, as well as salt Fields, there is growing concern that ports, which are seen as impeding the movement of containerized goods, are major bottlenecks.

CMA CGM said last week it planned to suspend its South American route from Le Havre for three months because of port congestion and operational inefficiencies. The announcement follows a similar statement by The Alliance, which said heavy congestion in Rotterdam forced seven sailings to The port.

Freight rates on European and American routes continue to rise

The freight market has entered the traditional peak season, and the freight price of the European and American routes has skyrocketed. The freight price of the Eastern line of the United States has broken through the sky-high price of $9000 /FEU for the first time.

According to the latest shipping rate data released by The Shanghai Export Container Freight Index (SCFI) on July 2, the SCFI composite index continued to rise to 3095.14 points last week, an increase of 119 points or 3.2% over the previous period. The Shanghai export container freight rate index continues to break through record highs. Quotations of all major airlines rose comprehensively, and the eastern freight rate of the United States soared by 310 USD to 9,254 USD /FEU, or 3.46%; Western routes also surged $228, or 4.8%, to $4,944 per FEU. A shortage of container equipment and continued congestion at ports will further push up rates in the second half of the year. Even premium service does not guarantee shipping space.

European routes rose $307, or 4.7%, to $6,786 /TEU, while Mediterranean routes continued to rise 2.1%, to $6,655 /TEU, both record highs.

Statistics show that since the second quarter, SCFI freight rate index has shown a continuous upward trend in 12 out of 13 weeks. The current freight rate increases significantly compared with the beginning of the year. The average SCFI freight rate index in the second quarter is 3240 points, significantly higher than the average of 2782 points in the first quarter. The eastern us line, in particular, is at a rate of $9,254 /FEU, almost double the level of about $4,700 /FEU at the beginning of the year.

Asia - North America (Trans-Pacific routes) : Due to port congestion, surging demand, capacity demand, and empty container rotation pressure increased, the west/east Coast of North America shipping space tight, freight rates rose. The shipping company has restricted access to goods from inland points; Schedule delays, capacity imbalances, inland transport delays, coupled with continued strong demand for imports from the Americas, shipping companies announced GRI increases in August and the imposition of port congestion charges PSS; Under the action of multiple factors, freight rates will rise further in July.

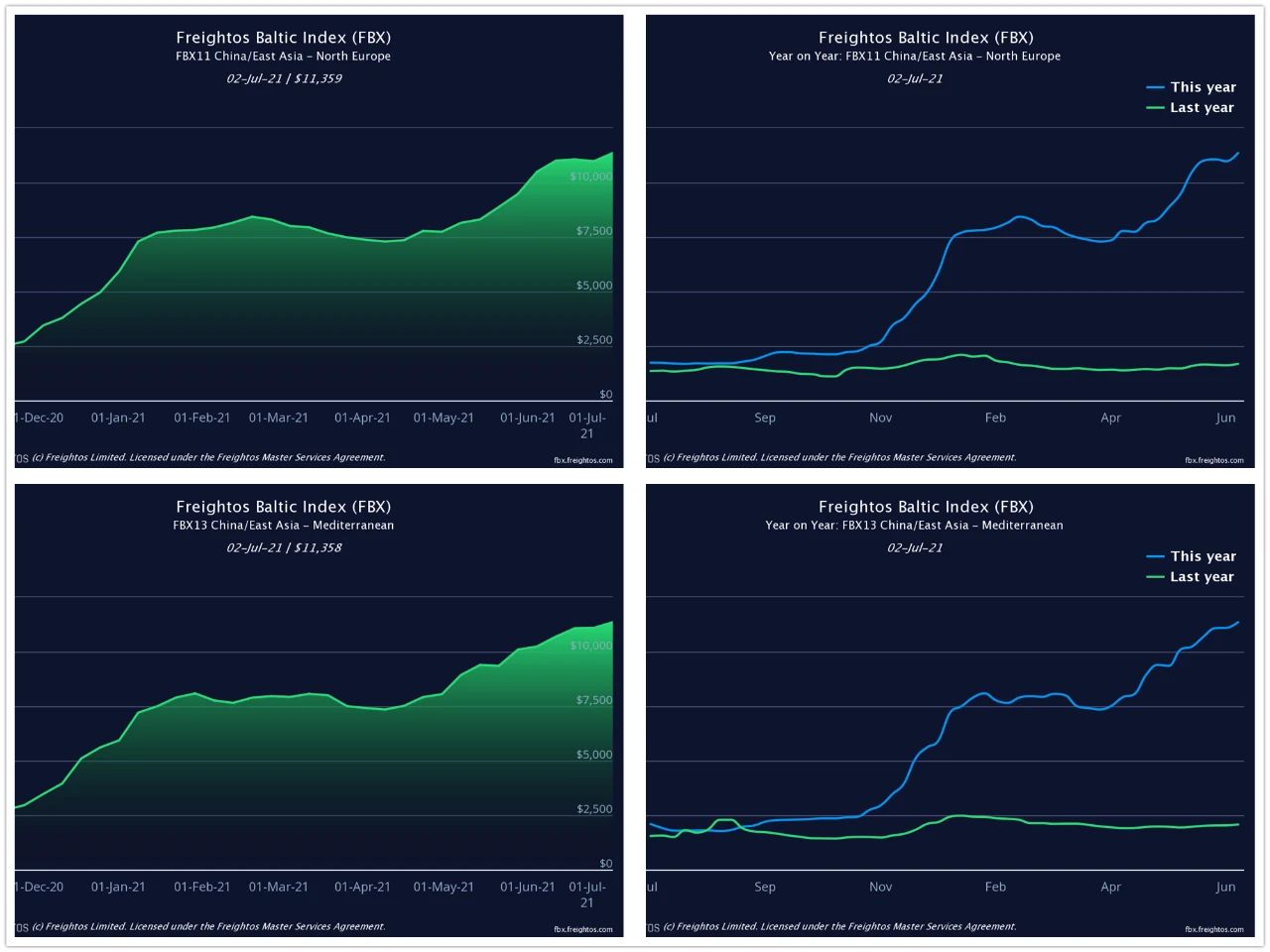

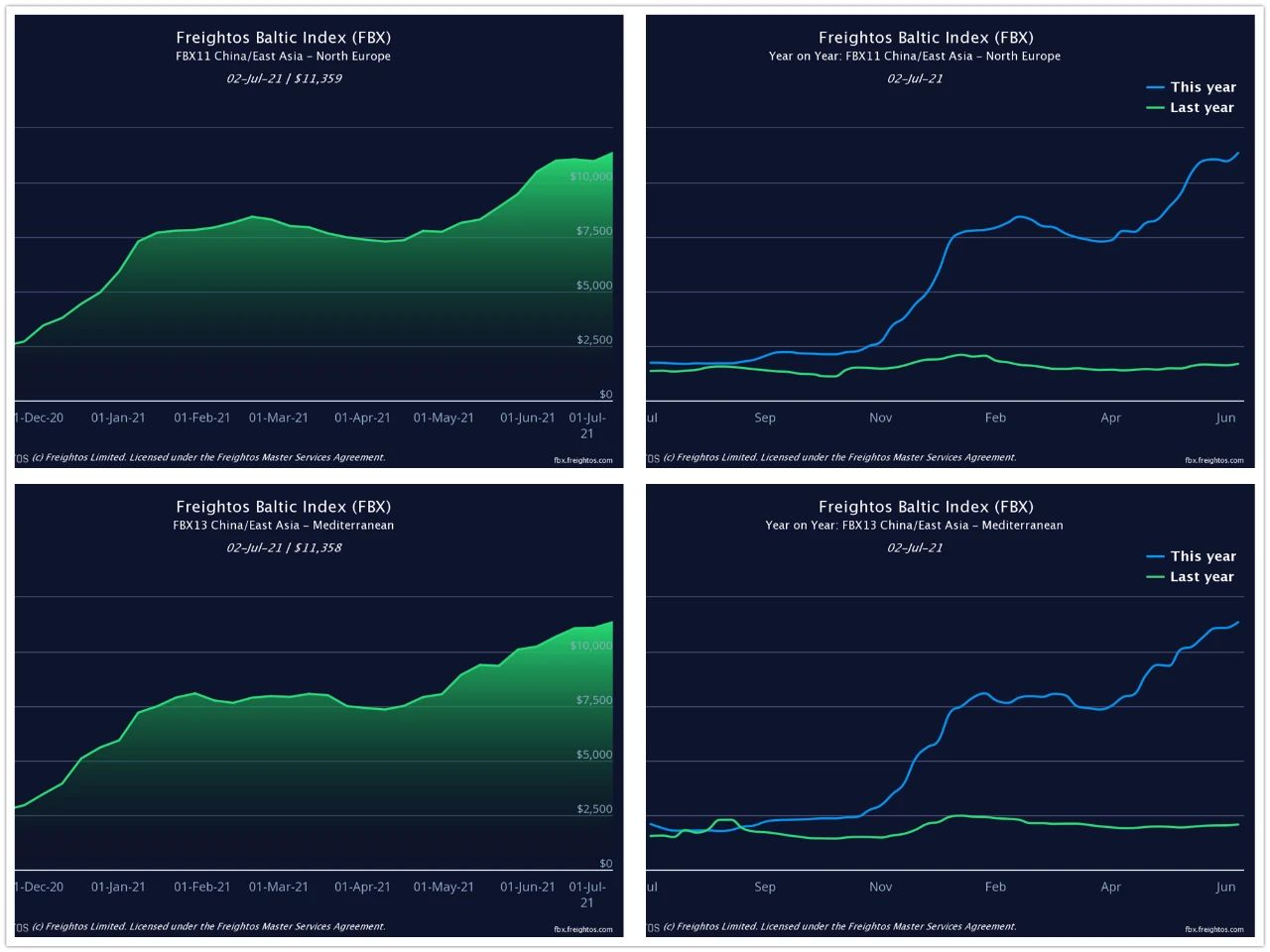

In the latest week, the Freightos Baltic Index, published by the Baltic Exchange and Freightos, showed that the Nordic freight Index was up 3% at $11,359 per 40 feet, and the Mediterranean Freight Index was up 2% at $11,358. The FBX on the West Coast was 6,745 dollars and on the East Coast 9,956 dollars.

FBX- East America west America

Asia-europe routes: Demand remains strong due to the backlog in June; The terminal congestion continues to worsen, and the shipping delay is expected to be as long as 5-15 days; Europe/Mediterranean market demand is strong, space is still very tight, rates will continue to rise.

FBX- Northern Europe Mediterranean

The third quarter will usher in the super peak season, freight rates skyrocket

The personage inside course of study points out, since this year the lack of ship, such problems as lack of box, lack of worker, port congestion layer upon layer overlay, as Europe and the United States in June unlock open buying patterns, in the third quarter of the market into the traditional peak season, demand far exceeds supply capacity, drive the freight has gone through the roof, this week is expected SCFI freight index is expected to break 4000 mark, drive the new sky-high freight agent again.

In July and August, major shipping companies around the world raised freight rates one after another. If additional fees such as peak season surcharges, fuel charges, and buying space fees are taken into account, the freight rates of the Far East to the Eastern line of the United States can reach 15,000-18,000 DOLLARS /FEU, the freight rates of the Western line of the United States have also exceeded 10,000 dollars /FEU, and the freight rates of the European line are about 15,000-20,000 dollars /FEU.

Analysts say congestion at European ports has worsened since the Suez Canal blockage in late March, exacerbated by the temporary closure of Yantian port and nearby ports due to the pandemic. Although yantian Port has resumed normal operation, it is still unable to fully digest in the short term, and the congestion situation of American ports has not improved so far. In the third quarter of this year, container shipping companies are expected to usher in a super peak season.

The National Retail Association expects strong demand for restocking will continue to drive up container rates as retailers' inventories remain at nearly 20-year lows.

Hackett Associates, a consultancy, expects U.S. container imports to reach more than 29 million TEUs in 2021, up 14.5% from 2020. The move will benefit Asian producers such as China, Japan and Vietnam, with U.S. imports from mainland China up 51.5 percent year on year and imports from the rest of Asia up 44.5 percent.

Liner companies will earn as much as $100 billion this year

Mr Drury now forecasts that container shipping will make record profits of $80bn in 2021, up from a previous forecast of $35bn. If rates beat forecasts for the rest of the year, Mr Drury said a $100bn annual profit line was not out of the question, which would be more than three times the all-time record for liner shipping.

"For the first time in the history of container shipping, carrier profits will approach $100bn and average rates will rise by 50 per cent against a backdrop of significant operational disruptions to ports and ship systems," the UK consultancy noted.